Why Generate Bounded Forecasts?

In forecasting, we often want to make sure the predictions stay within a certain range. For example, for predicting the sales of a product, we may require all forecasts to be positive. Thus, the forecasts may need to be bounded. This tutorial shows how to generate bounded forecasts with TimeGPT by transforming data prior to forecasting.Tutorial

Step 1: Import Packages

First, we install and import the required packages.Step 2: Load Data

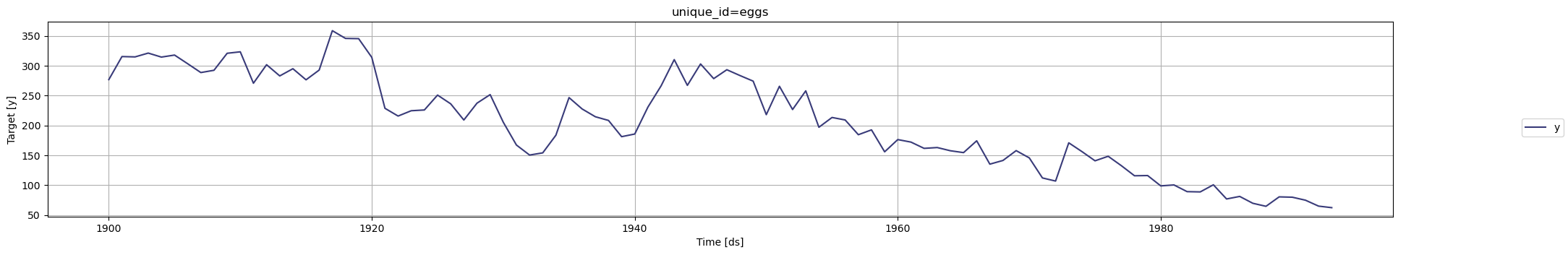

We use the annual egg prices dataset from Forecasting, Principles and Practices. We expect egg prices to be strictly positive, so we want to bound our forecasts to be positive.NOTE: If you do not havepyreadr, you can install it withpip:

| ds | y | unique_id | |

|---|---|---|---|

| 84 | 1984-01-01 | 100.58 | eggs |

| 85 | 1985-01-01 | 76.84 | eggs |

| 86 | 1986-01-01 | 81.10 | eggs |

| 87 | 1987-01-01 | 69.60 | eggs |

| 88 | 1988-01-01 | 64.55 | eggs |

| 89 | 1989-01-01 | 80.36 | eggs |

| 90 | 1990-01-01 | 79.79 | eggs |

| 91 | 1991-01-01 | 74.79 | eggs |

| 92 | 1992-01-01 | 64.86 | eggs |

| 93 | 1993-01-01 | 62.27 | eggs |

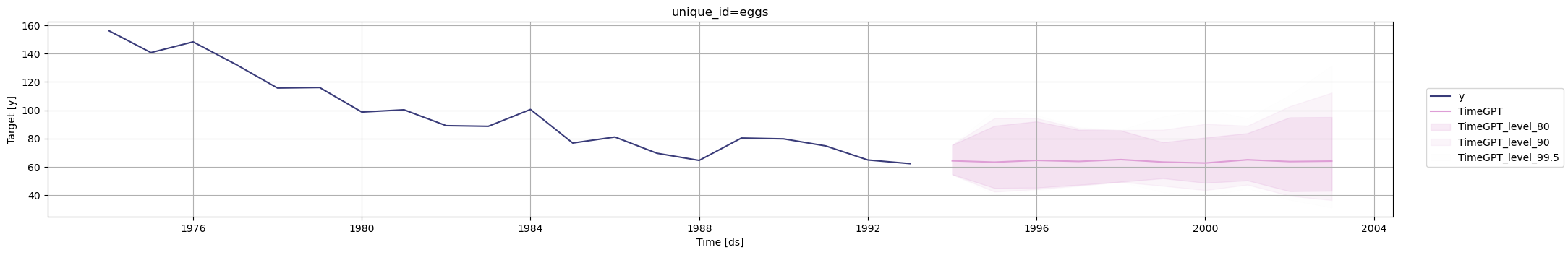

Step 3: Generate Bounded Forecasts with TimeGPT

First, we transform the target data. In this case, we will log-transform the data prior to forecasting, such that we can only forecast positive prices.

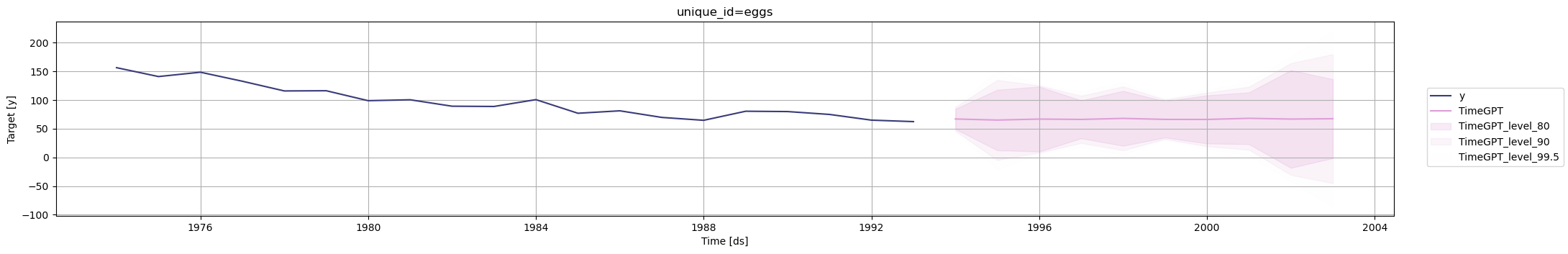

Step 4: Compare with Unbounded Forecast

Let’s compare these forecasts to the situation where we don’t apply a transformation. In this case, it may be possible to forecast a negative price.

| unique_id | ds | TimeGPT | TimeGPT-lo-99.5 | TimeGPT-lo-90 | TimeGPT-lo-80 | TimeGPT-hi-80 | TimeGPT-hi-90 | TimeGPT-hi-99.5 | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | eggs | 1994-01-01 | 66.859756 | 43.103240 | 46.131448 | 49.319034 | 84.400479 | 87.588065 | 90.616273 |

| 1 | eggs | 1995-01-01 | 64.993477 | -20.924112 | -4.750041 | 12.275298 | 117.711656 | 134.736995 | 150.911066 |

| 2 | eggs | 1996-01-01 | 66.695808 | 6.499170 | 8.291150 | 10.177444 | 123.214173 | 125.100467 | 126.892446 |

| 3 | eggs | 1997-01-01 | 66.103325 | 17.304282 | 24.966939 | 33.032894 | 99.173756 | 107.239711 | 114.902368 |

| 4 | eggs | 1998-01-01 | 67.906517 | 4.995371 | 12.349648 | 20.090992 | 115.722042 | 123.463386 | 130.817663 |

| 5 | eggs | 1999-01-01 | 66.147575 | 29.162207 | 31.804460 | 34.585779 | 97.709372 | 100.490691 | 103.132943 |

| 6 | eggs | 2000-01-01 | 66.062637 | 14.671932 | 19.305822 | 24.183601 | 107.941673 | 112.819453 | 117.453343 |

| 7 | eggs | 2001-01-01 | 68.045769 | 3.915282 | 13.188964 | 22.950736 | 113.140802 | 122.902573 | 132.176256 |

| 8 | eggs | 2002-01-01 | 66.718903 | -42.212631 | -30.583703 | -18.342726 | 151.780531 | 164.021508 | 175.650436 |

| 9 | eggs | 2003-01-01 | 67.344078 | -86.239911 | -44.959745 | -1.506939 | 136.195095 | 179.647901 | 220.928067 |